We are Your Wealth Architects

Designing the plan for the next phase of your life

Creating Your Wealth Management Blueprint

Building a solid financial strategy for your future requires sophisticated planning. We’ve designed a process to work through your plan together, beginning with a number of conversations about thought-provoking questions that help us understand your most important values, aspirations and relationships.

Once we’ve collaborated on identifying and prioritizing your objectives, we custom-design an investment strategy that’s tailored to your individual income needs and financial goals. To give you access to a wide range of products, services and market research, we’ve partnered with one of the nation’s most respected independent broker-dealers, LPL Financial. Over time, we stay in close touch with you to keep your strategy updated as your life changes and your needs evolve.

Our Approach to Retirement Planning

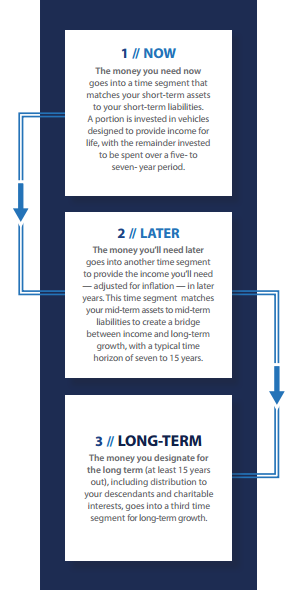

The Bucket Strategy®

To create your personalized plan for retirement, we use The Bucket Strategy®. The Bucket Strategy® matches your assets to your liabilities, using strategic investments to draw income when needed and allowing time for other investments in the portfolio to potentially grow.

Investments are bucketed into three categories that correspond to various stages of your retirement based on your evolving income needs.

Guarantees are based on the claims paying ability of the issuing insurance company. Investing involves risks including the potential loss of principal. No strategy can assure success or protects against loss. Past performance is no guarantee of future results.

The Bucket Strategy® involves investments subject to risks, fees, and expenses. There is no guarantee that any investing strategy will be profitable or provide protection from loss.

Principles Essential to Retirement Planning

The plan we work with you to create includes much more than retirement income planning. It addresses 13 principles that we consider essential to a robust wealth management strategy.

- Creating an investment strategy

- Reviewing insurance needs

- Managing liabilities

- Establishing a qualified retirement plan and/or IRA distribution

- Exercising stock options, if applicable

- Having a business succession plan in place

- Setting up a durable power of attorney

- Determining what you’d like to gift to children, descendants or others during your lifetime

- Managing charitable giving during your lifetime

- Ensuring that assets are correctly titled

- Selecting your executor/trustee

- Drawing up a plan for distribution of your assets to your spouse or descendants upon your death

- Identifying charitable giving to take place upon your death

Legal services are not offered by Accardi Financial Group, LPL Financial or affiliated advisors.

Products and Services

We provide assistance in the following areas

Request an Appointment

Start Building Your Retirement Plan Today

Start your strategy and gain personalized investment advice and support to help grow your portfolio.

"*" indicates required fields